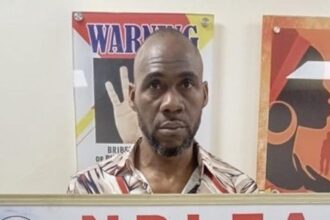

A Federal High Court sitting in Makurdi, Benue State, has sentenced Agene Johnson Godwin, the Managing Director of Builderstech Solution Ltd, to 48 years imprisonment without an option of fine for orchestrating a large-scale investment fraud that swindled more than 5,000 Nigerians of over ₦500 million.

The conviction, secured by the Economic and Financial Crimes Commission (EFCC), represents one of the most severe sentences handed down in recent years for financial crimes and is being widely viewed as a significant milestone in Nigeria’s fight against investment fraud and financial exploitation.

The EFCC disclosed the development in an official post on its verified X (formerly Twitter) handle, announcing that Justice M. S. Abubakar of the Federal High Court, Makurdi, delivered the judgment after finding Godwin guilty on an amended eight-count charge.

“Makurdi Court Jails Agene Johnson Godwin 48 Years Over Investment Scam. Justice M.S. Abubakar of the Federal High Court, Makurdi has sentenced the Managing Director, Builderstech Solution Ltd, Agene Johnson Godwin, to 48 years imprisonment without option of fine for defrauding over 5,000 unsuspecting victims to the tune of over ₦500,000,000 (Five Hundred Million Naira),” the EFCC stated.

According to the anti-graft agency, the offences stemmed from fraudulent investment schemes promoted by Builderstech Solution Ltd, through which Godwin allegedly lured thousands of Nigerians with promises of high and guaranteed returns. Many of the victims reportedly invested their life savings, pensions, and borrowed funds, only to discover that the scheme was a sham.

Court documents revealed that Godwin used aggressive marketing tactics and false representations to convince members of the public that Builderstech Solution Ltd was engaged in legitimate, high-yield investment ventures. Instead of deploying the funds for genuine business activities, prosecutors argued that the money was misappropriated, leading to devastating financial losses for investors across the country.

Delivering judgment, Justice Abubakar held that the prosecution had proven its case beyond reasonable doubt. The court found that the convict knowingly and intentionally defrauded his victims, exploiting their trust and financial vulnerability for personal gain. In imposing the 48-year sentence, the judge emphasised the scale of the fraud, the number of victims involved, and the severe economic and psychological harm inflicted.

Legal analysts say the sentence sends a strong message that the judiciary is prepared to impose stiff penalties on perpetrators of large-scale financial crimes, particularly those that prey on ordinary citizens seeking economic opportunities in a challenging environment.

The case has also reignited public discourse on the prevalence of fraudulent investment schemes in Nigeria, especially in the digital and informal financial sectors. Over the past decade, thousands of Nigerians have fallen victim to Ponzi schemes, fake trading platforms, and unregulated investment outfits promising unrealistic returns.

The Builderstech conviction comes amid heightened enforcement efforts by the EFCC to combat financial crimes, including cyber fraud, cryptocurrency scams, and illicit investment platforms.

In a related development, the EFCC in May 2025 announced the recovery of part of an estimated ₦1.3 trillion allegedly stolen from Nigerians through the now-defunct digital investment platform, Crypto Bridge Exchange (CBEX). The platform had attracted massive participation, particularly from young Nigerians, before it suddenly collapsed, wiping out the savings of thousands of investors.

The EFCC Chairman, Mr Ola Olukoyede, disclosed the recovery during an interview with TVC, stating that the commission had made significant progress in tracing and reclaiming stolen assets linked to the CBEX fraud.

“We have gone far with CBEX. We have been able to recover a reasonable amount of money,” Olukoyede said. He added that several suspects connected to the scam had been arrested and were under investigation.

According to the EFCC chairman, one of the major challenges in the CBEX case was that much of the stolen funds were held in cryptocurrency, making tracking and recovery complex. However, he confirmed that the commission had succeeded in tracing digital wallets associated with the fraud and recovering part of the assets.

He also acknowledged difficulties encountered in converting the recovered cryptocurrency into cash, particularly United States dollars, due to the technical and regulatory hurdles involved. Despite these challenges, Olukoyede assured Nigerians that the EFCC remained committed to pursuing the case to its logical conclusion.

SaharaReporters had earlier reported extensively on the CBEX collapse, detailing how the platform’s sudden shutdown left thousands of investors devastated. Many victims, especially young people, had invested their tuition fees, business capital, and personal savings, believing CBEX to be a legitimate and regulated investment opportunity.

The recurring pattern of such schemes has raised concerns among regulators, civil society groups, and financial experts, who continue to call for stronger financial literacy, stricter regulation of investment platforms, and more robust enforcement mechanisms.

The conviction of Agene Johnson Godwin is therefore being hailed as a crucial deterrent, reinforcing the message that those who exploit public trust for financial gain will face severe consequences. Observers note that while prosecutions and convictions are essential, preventing such crimes will also require sustained public education and improved oversight of the investment space.

For many of the victims, however, the sentence offers a measure of justice, even as questions remain about the possibility of recovering their lost funds. The EFCC has not yet disclosed whether additional asset forfeiture or restitution orders will follow the judgment.

As Nigeria continues to grapple with economic pressures that make citizens vulnerable to fraudulent schemes, the Builderstech case stands as a stark reminder of the risks of unverified investments—and of the growing resolve of law enforcement agencies and the courts to hold perpetrators accountable.